Seminars

PROJECT FINANCING AND FACILITATION – SKILLS YOU NEED TO ACHIEVE THE OBJECTIVES AND WITHIN BUDGET

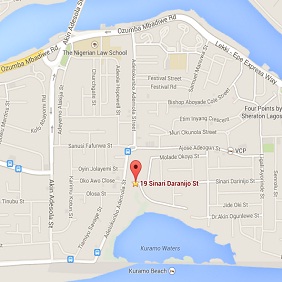

Duration - 4 days; Fee - $1480 Venue – London, Nigeria & Ghana

Contact us for dates and volume discount

Who is seminar for?

Managers and supervisors who want to develop a more effective non-directive leadership style, and who often face group situations and anyone wanting to make group situations more effective. Managers and staff who wish to understand the financial issues and considerations involved in the preparation and monitoring of projects

What is it about?

A course that will give you the skills and techniques required to get the most out of individuals in all challenging group situations, not just formal meetings. This is not about chairing meetings but about stimulating group dynamics in focus groups, team development workshops or committees Control and guide any group towards its objectives.

Course Overview

• The role of the facilitator

• Appreciate the difference between “process” and “content”

• The skills required

• Understand group dynamics

• Levels of intervention

• Determine the skills required

• Agree what is expected from the facilitator

• People and task issues

• The ability to stay neutral when necessary

• What does and doesn’t work

• Develop mental resilience

• Be firm without causing upset

• Handle difficult situations

• The emotional cycle of change

• Catalytic skills

• Interventions that stimulate the process

• Establish ground rules

• Problem solving techniques

• The mastery ladder

What do I get out of it?

• Understanding of group dynamics

• Confidence to handle those being over dominating in a group situation

• Ability to bring out those not contributing in a meeting

• Techniques to intervene to stimulate discussion

• Understanding of left and right brain thinking and how to exploit both

• Basic problem solving techniques

Improve financial control to ensure completion within budget

What is it about/

Bringing a project in on time and to budget requires a particular skill set. To do it successfully you need to have a thorough understanding of the financial implications of the variables within your project. This course will enable you to set budgets, master terminology, evaluate risk, interpret data and forecast cash flow and final profit and loss on any project

Course Overview

• The need for financial planning

• Basic concepts

• Prudence and consistency

• Revenue vs. Capital

• Cost and revenue

• Depreciation

• Value Added Tax – an introduction

• Cost factors – the common pitfalls

• Discounts – assessing the impact

• Compiling the project cost budget

• Compiling the actual with budget

• Costs to complete

• Controlling project changes

• Updating the financial plan

• Financial controls – purchases and income

• Contractual terms – the financial issues

• Summary – avoiding the common pitfalls

What do I get out of it?

• Ability to evaluate the business case for any project

• Understanding of key financial terms and concepts

• Skills to create a cash flow forecast for a project

• Interpretation of project management accounts

.gif)